Some Known Details About Estate Planning Attorney

Table of ContentsIndicators on Estate Planning Attorney You Should KnowThe Buzz on Estate Planning AttorneyAll about Estate Planning AttorneyThe 8-Second Trick For Estate Planning AttorneyThe 25-Second Trick For Estate Planning Attorney

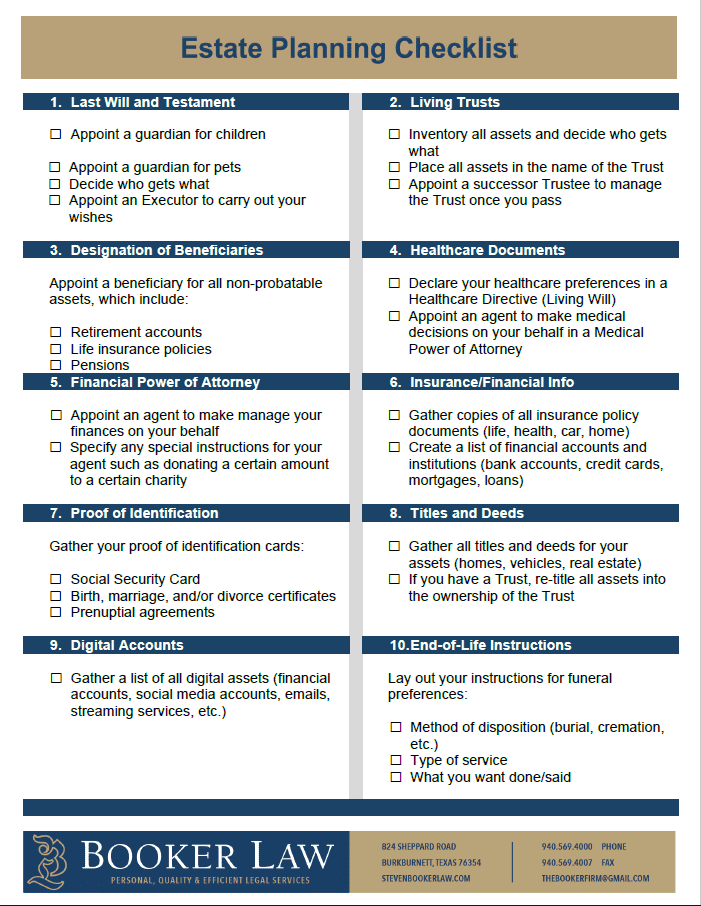

Encountering end-of-life choices and safeguarding family members wealth is a difficult experience for all. In these hard times, estate preparation lawyers help individuals intend for the distribution of their estate and develop a will, depend on, and power of lawyer. Estate Planning Attorney. These attorneys, also referred to as estate legislation lawyers or probate lawyers are certified, seasoned specialists with an extensive understanding of the government and state legislations that put on just how estates are inventoried, valued, dispersed, and taxed after death

The intent of estate planning is to appropriately plan for the future while you're sound and qualified. A properly prepared estate plan outlines your last dreams specifically as you desire them, in one of the most tax-advantageous way, to stay clear of any questions, false impressions, misconceptions, or disputes after fatality. Estate preparation is a specialization in the lawful occupation.

The Facts About Estate Planning Attorney Revealed

These lawyers have an extensive understanding of the state and federal regulations associated with wills and depends on and the probate process. The responsibilities and responsibilities of the estate lawyer may include counseling clients and preparing legal records for living wills, living depends on, estate plans, and estate taxes. If required, an estate preparation attorney might take part in lawsuits in court of probate in support of their clients.

According to the Bureau of Labor Data, the employment of attorneys is anticipated to grow 9% in between 2020 and 2030. About 46,000 openings for attorneys are predicted yearly, generally, over the years. The course to coming to be an estate planning lawyer is similar to various other practice areas. To get involved in regulation school, you have to have a bachelor's degree and a high GPA.

If feasible, consider possibilities to get real-world work experience with mentorships or internships related to estate planning. Doing so will give you the abilities and experience to make admittance into legislation school and connect with others. The Law Institution Admissions Test, or LSAT, is a crucial element of relating to legislation college.

Usually, the LSAT is available 4 times annually. official site It is necessary to plan for the LSAT. A lot of potential pupils begin studying for the LSAT a year in development, typically with a study hall or tutor. Most law pupils look for regulation school during the fall term of the last year of their undergraduate researches.

A Biased View of Estate Planning Attorney

Generally, the yearly wage for an estate attorney in the U.S. is $97,498. Estate Planning Attorney. On the luxury, an estate planning lawyer's salary might be $153,000, according to ZipRecruiter. The estimates from Glassdoor are similar. Estate intending lawyers can function at huge or mid-sized law firms or branch off by themselves with a solo technique.

This code relates to the limits and regulations troubled wills, depends on, and various other lawful documents relevant to estate preparation. The Uniform Probate Code can look at this web-site vary by state, but these regulations regulate various facets of estate planning and probates, such as the production of the depend on or the lawful legitimacy of wills.

Are you unsure concerning what career to go after? It is a complicated question, and there is no very easy response. You can make some factors to consider to help make the decision much easier. Initially, take a seat and note the important things you are proficient at. What are your staminas? What do you appreciate doing? When you have a checklist, you can limit your alternatives.

It involves choosing exactly how your ownerships will certainly be distributed and that will manage your experiences if you can no much longer do so on your own. Estate planning is a required part of financial planning and need to be finished with the aid of a certified expert. There are several variables to take into consideration when estate preparation, including your age, wellness, economic circumstance, and household situation.

Some Of Estate Planning Attorney

If you are young and have few belongings, you might not require to do much estate planning. However, if you are older and have better, you should take into consideration distributing your properties amongst your heirs. Wellness: It is a vital factor to think about when estate planning. If you are in healthiness, you might not need to do much estate planning.

If you are married, you have to think about how your possessions will certainly be distributed in between your spouse and your heirs. It intends to make sure that your properties are dispersed the look at these guys method you desire them to be after you pass away. It consists of considering any type of tax obligations that may need to be paid on your estate.

A Biased View of Estate Planning Attorney

The attorney likewise helps the people and families create a will. A will certainly is a legal paper specifying how individuals and families desire their assets to be distributed after fatality. The attorney also helps the people and families with their depends on. A count on is a lawful document enabling people and family members to transfer their assets to their beneficiaries without probate.